Rockland County Property Appraiser

County Executive Day Unveils Proposed 2026 Budget

New City, NY, - Rockland County Executive Ed Day unveiled his proposed 2026 $913.8 million budget at the Robert Yeager Health Complex in ...

https://www.rocklandcountyny.gov/Home/Components/News/News/919/746?widgetId=3605The County Executive's Corner: The 2026 Budget

Zero Increase in County Property Taxes for 2026 When I first took office more than a decade ago, Rockland was on the brink of fiscal ...

https://rocklandtimes.com/2025/10/06/the-county-executives-corner-the-2026-budget/County Budget Rockland County, NY

The 2026 Adopted Budgets are available for download below. If you have any questions or suggestions, please feel free to call (845) 364-3870 for assistance.

https://www.rocklandcountyny.gov/departments/county-executive/budgetZero Increase in County... - Rockland County Government Facebook

Through disciplined budgeting, tough decisions, and smart planning, we transformed our fiscal health from worst to first. #RocklandCounty now stands as the only county in New York State with Moody’s highest possible Triple-A bond rating. That is an incredible accomplishment, and it means we are recognized nationally as one of the fiscally strongest counties in the state.

https://www.facebook.com/rocklandgov/posts/zero-increase-in-county-property-taxes-proposed-for-2026-budgetthrough-disciplin/1421258786235828/

Rockland County executive unveils 2026 budget with 0% ...

Rockland County Executive Ed Day unveiled his proposed budget for 2026. The nearly $914 million plan includes a 0% increase in property tax. It also ...

https://westchester.news12.com/rockland-county-executive-unveils-2026-budget-with-0-increase-in-property-taxCouncil approved the 2026 operating and capital budget at its December 16, 2025, regular Council meeting. It provides Council’s direction on spending for the coming and future years and allows administration to implement Council’s directed service levels for the municipality. Read more: www.rockymtnhouse.com/p/budget It provides Council’s direction on spending for the coming and future years and allows administration to implement Council’s dir...

https://www.instagram.com/p/DSdnRhCjL4K/

County Executive Ed Day Proposes Zero County Property Tax Increase for 2026 $913.8 Million Budget - Rockland County Business Journal

Day, Who Is Running For Re-Election This November, Touts Financial Stewardship But Budget Speech Is Light on Details Rockland County Executive Ed Day is proposing no property tax increase for 2026’s $913.8 million budget. Last year’s budget was $876 million. For the past two years, the County’s office fashioned a 2 percent tax cut, coming on the heels of zero tax increases in 2022 and 2023.

https://rcbizjournal.com/2025/09/30/county-executive-ed-day-proposes-zero-county-property-tax-increase-for-2026-913-8-million-budget/

Legislature Approves 2026 Budget - Rockland News - No paywall. No paper. Just the facts.

New City, NY — In a unanimous and bipartisan vote, the Rockland County Legislature approved an amended 2026 budget on Tuesday that keeps county property taxes flat, avoids workforce layoffs, and increases funding for key programs and community organizations. The $913.8 million spending plan—originally proposed by the County Executive in October—represents a 4.26 percent increase over the 2025 budget.

https://rocklandnews.com/legislature-approves-2026-budget/

Rockland County Property Tax Grievance Aventine Properties

Permanent Tax Savings Ongoing property tax reduction benefit year after year until a town wide reassessment happens. No Upfront Fees You only pay if we obtain a reduction on your assessment. File with us with no payment required! No Downside or Risk Your property assessment can only be reduced.

https://aventineproperties.com/rockland-county-tax-grievance/

Rockland County Executive Ed Day Presents 2026 Budget With No Property Tax Increase - Monsey Scoop

Rockland County Executive Ed Day unveiled his proposed $913.8 million 2026 budget on Tuesday at the Robert Yeager Health Complex in Pomona, announcing that the plan contains no increase in County property taxes. Day explained that while his original goal had been to continue cutting taxes — noting that residents have already seen a 4% reduction over the past two years — rising costs and uncertainty about state and federal...

https://monseyscoop.com/rockland-county-executive-ed-day-presents-2026-budget-with-no-property-tax-increase/

Legislative Research: NY S08533 2025-2026 General Assembly LegiScan

Legislative Research: NY S08533 | 2025-2026 | General Assembly Other Sessions References Online Legislative Citation APA NY S08533 | 2025-2026 | General Assembly. (2026, January 07). LegiScan. Retrieved January 24, 2026, from https://legiscan.com/NY/bill/S08533/2025 MLA "NY S08533 | 2025-2026 | General Assembly." LegiScan.

https://legiscan.com/NY/research/S08533/2025

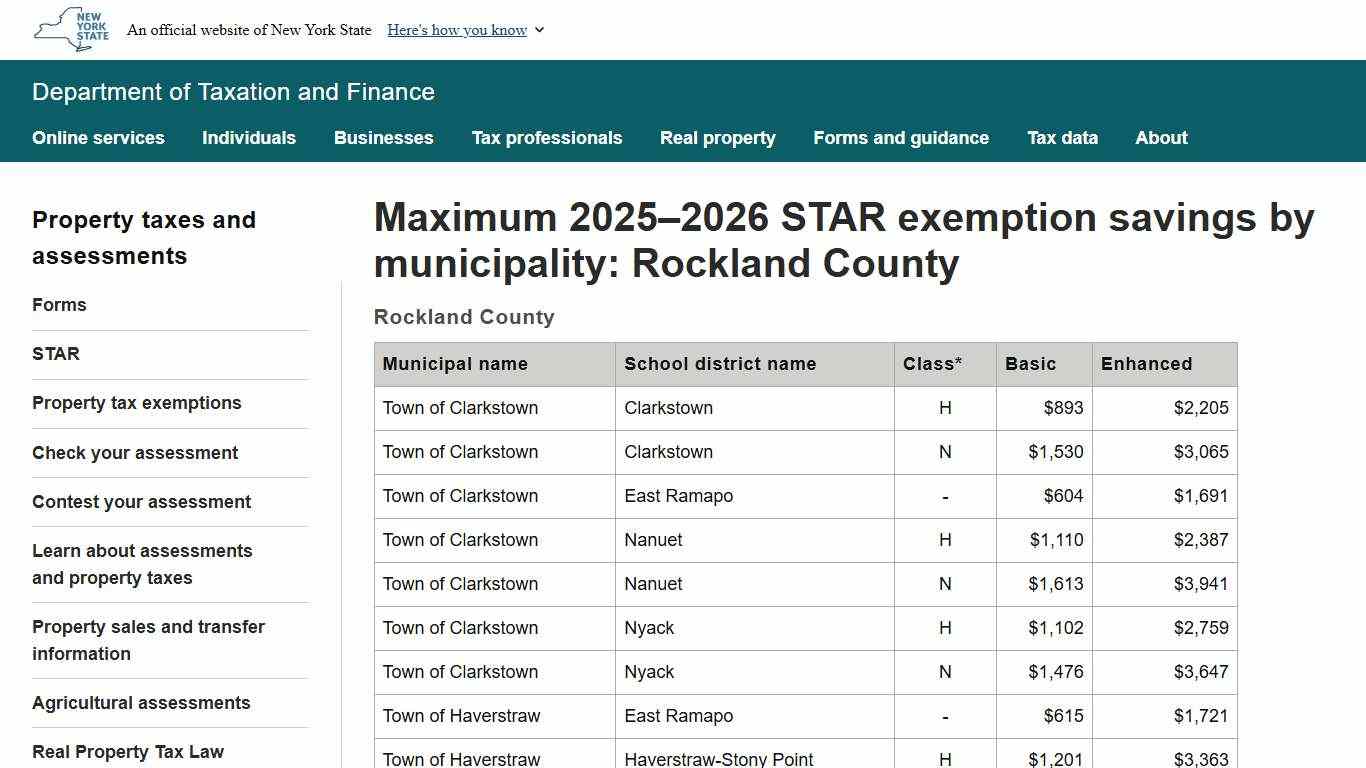

Maximum 2025–2026 STAR exemption savings by municipality: Rockland County

Maximum 2025–2026 STAR exemption savings by municipality: Rockland County * Class refers only to school districts that exercise the homestead/non-homestead tax option, or that are based within special assessing units (Nassau County or NYC). Page last reviewed or updated:...

https://www.tax.ny.gov/pit/property/star/max-savings/municipality/muni39.htm

Rockland County legislators voted unanimously to amend and approve the 2026 County Budget — keeping county property taxes stable while funding vital programs, services, and nonprofits. The bipartisan budget boosts support for: 🔹 Nonprofits serving children, seniors, and families 🔹 Veterans’ services (+$146K) 🔹 Tourism & economic development (+$509K) 🔹 Preserves Funding for Affordable Housing initiatives 🔹 Preserves funding for Countywide sidew...

https://www.instagram.com/p/DRyPvowFVA4/

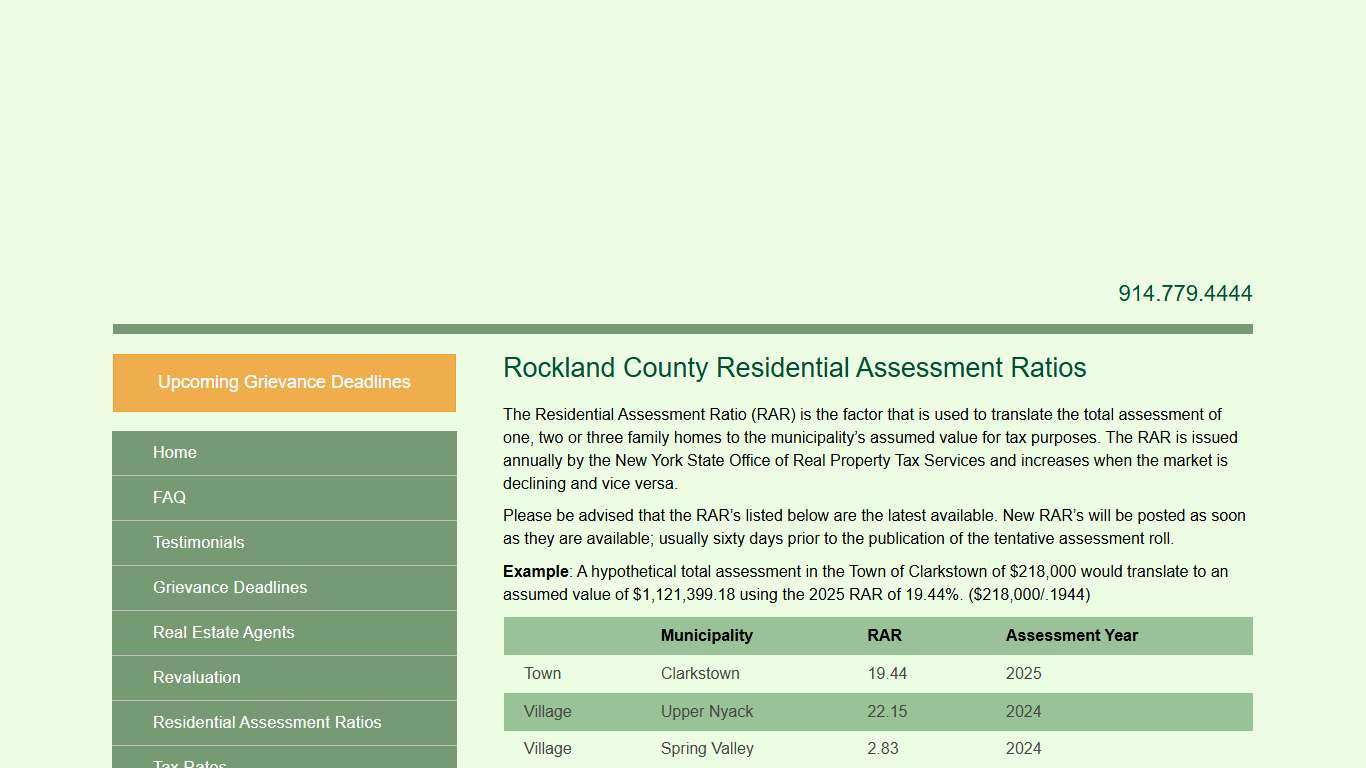

Rockland County Residential Assessment Ratios - O'Donnell & Cullen Property Tax Consultants

The Residential Assessment Ratio (RAR) is the factor that is used to translate the total assessment of one, two or three family homes to the municipality’s assumed value for tax purposes. The RAR is issued annually by the New York State Office of Real Property Tax Services and increases when the market is declining and vice versa.

https://retiredassessor.com/residential-assessment-ratios/rockland-county-residential-assessment-ratios/